How many of you are guilty of looking up the oil prices at any point this year? I will gladly say that I have looked up the prices not once or twice, but many times. Sometimes it was out of curiosity and sometimes, it was hope that I would wake up one morning and the price would be magically above $100/barrel. Well, let’s be more realistic…I was even hoping the price would reach above $50/barrel! Obviously, at least for this past year, my wishful thinking never came to be true. However, I don’t want to blog about the low prices…been there, done that. When you look up the price of oil, you usually run into two different prices: Brent and WTI.

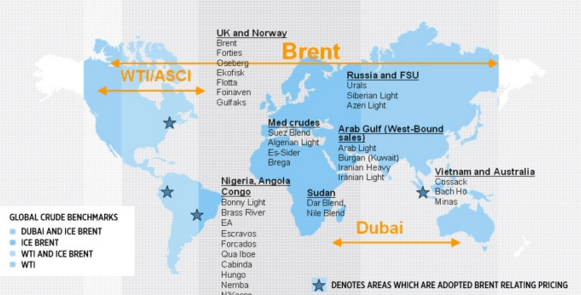

So what is Brent and WTI, and what is the difference between the two? These are pricing benchmarks for crude oil. There are really dozens of different benchmarks but Brent and WTI are just two of the most widely used. You see, there are different types of crude oil, and some are more desired than others. Depending on the type of oil, the location it comes from, and what it is being used for is what determines which contract the buyer’s purchases.

Brent

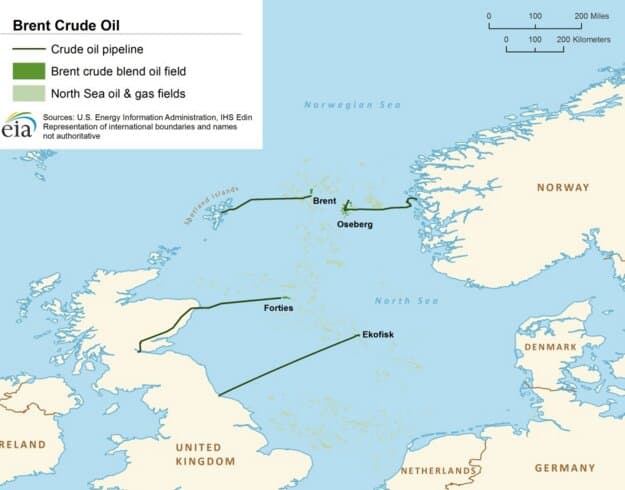

Brent refers to crude oil from four different oilfields in the North Sea: Brent, Forties, Oseberg, and Ekofisk. Out of all the crude contracts around the world, about two-thirds of them use Brent as a pricing benchmark. This makes Brent the most widely used marker. The oil extracted from Brent is usually light and sweet, making it easy to refine into diesel fuel, gasoline, and other products. The oil supply is also water-borne, which makes it easy to transport to distant locations. It makes sense why Brent holds two-thirds of the contracts!

WTI

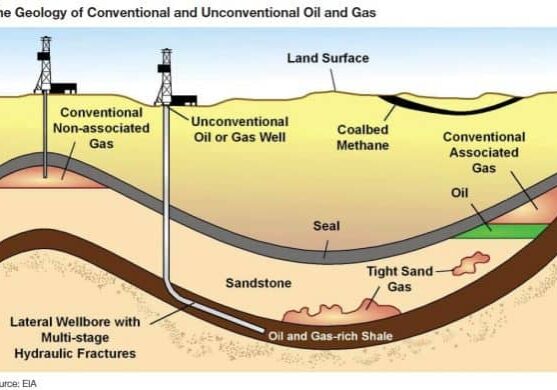

WTI or West Texas Intermediate, is pretty important in my neck of the woods. Why? Well, because WTI refers to the crude oil that is extracted in the United States and travels by pipeline to the hub in Cushing, Oklahoma. The oil from WTI is a lot like Brent in the sense that the oil is light and sweet. This makes it ideal for gasoline refinement in particular. Although the quality of the oil is very similar between WTI and Brent, WTI is more limited to contracts inside of the U.S. because suppliers are landlocked. This makes shipping this oil across the globe pretty expensive.

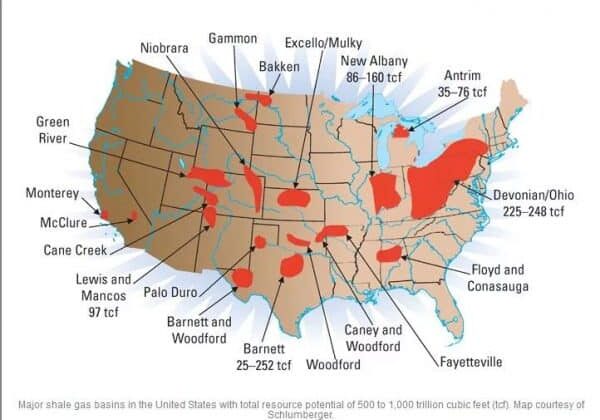

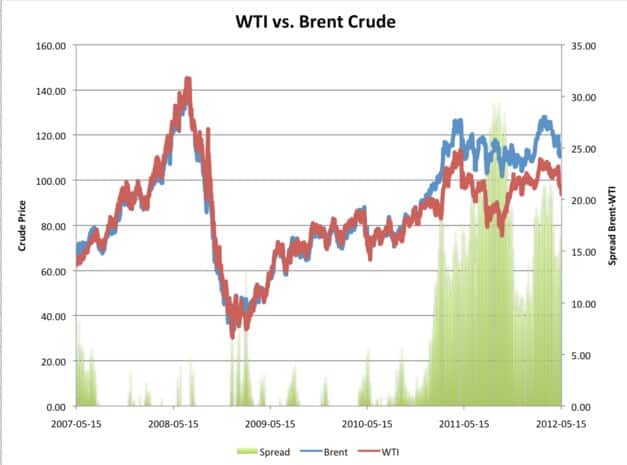

Prior to 2011, the price between Brent and WTI remained very similar. So why the change in 2011? Simply look back on the United States history when it comes to drilling for oil. A lot has happened since 2011… I have even done blog posts on the shale boom that has occurred over recent years. Due to the use of new drilling technology, an increase of supply, and increased infrastructure, the WTI price has stayed slightly lower than the Brent price.

Even on Croft’s website, we have the updated oil and natural gas pricing on our home page. We have always had both the Brent and WTI pricing but I never really thought twice about why the prices were different or what each meant. It is so interesting to me that it is simply the cost of oil in different areas. These just so happen to be the two areas most buy contracts from. So these are the most relevant prices. Ya learn something new every day!