For this blog, I have taken a post from CROFT employee Jessica Lee in 2015 about the drop in gas prices and have revised it to match the 2017 gas price increase.

In 2015 gas prices were dropping quickly and as excited as people were to fill up their cars’ entire tank for only $23, they also realized that this meant businesses and people were hurting. As gas prices dropped from $108 per barrel in 2014 to $43 per barrel in 2015, and finally in 2016 oil prices dropped to $29 per barrel, that is the lowest oil price in over 20 years. So many people were affected by this downturn whether they were part of the oil and gas industry or not. I personally knew nothing about oil and gas however I knew people that were directly affected and were hurting. By 2016 there were over 195,000 American jobs lost due to the downturn in the oil and gas market. I didn’t quite understand how or why this was happening, which is why I wanted to take the time to revise this blog. I think it is important for us to reflect and understand what affects natural gas prices, if gas prices have any impact on the price of natural gas (since the majority of our electricity comes from natural gas), and what to expect next as far as pricing goes.

What Affects Natural Gas Prices?

You’ll never guess what makes a difference on natural gas pricing. It’s supply and demand, of course! Did memories from your first class of economics just come running back to you? Let’s talk about supply first.

Some of the factors that affect prices on the supply side:

- How much of it is being produced

- Production has been steadily increasing so in turn, prices have been able to stay relatively cheap at less than $4 on average since 2009.

- The amount in underground storage

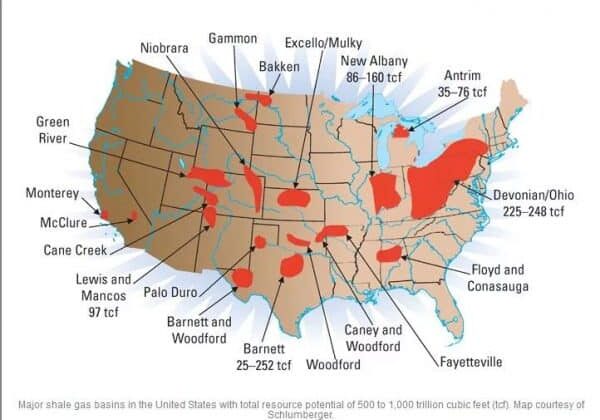

- When demand for natural gas is at its lowest, during summer months, the levels of storage replenish and increase. So during winter months, when demand for natural gas is at its highest, the gas is still available because of the amount that is able to be stored. In fact, here is an interesting side note…there is about 2,474 Tcf of natural gas that is technically recoverable in the U.S. and the rate of consumption in 2014 was 26 Tcf/year estimating that the U.S. has enough natural gas to last about 93 years.

- The amount being imported or exported

- The majority of the natural gas that is consumed in the U.S. comes from production within its boundaries. However, the U.S. is also considered a net importer, meaning that we import more natural gas than we export. In 2015 and 2016 oil and gas imports increased and so did the consumption. But with a majority of gas coming from inside the United States, this helps keep the price low.

If supply is increased then prices tend to go down and if supply if decreased, then prices tend to rise. If there is an increase in prices, production is often encouraged.

Factors on the demand side that affect pricing:

- Amount of economic growth

- Economic growth and natural gas markets go hand in hand. If the strength of the economy is growing, the demand for goods and services increases generating an increase in demand for natural gas. Especially for industries that use natural gas as plant fuel and feedstock for many products. If the economy is down, the use of natural gas will decline since goods and services also decline.

- Winter and summer weather

- This is a huge playing factor in the demand for natural gas. The weather is sometimes unpredictable making the demand fluctuate at any time. For example, in 2005 hurricanes along the gulf coast resulted in shutting down 4% of total U.S. natural gas production from August 2005 to June 2006. So for this reason, the price can increase because supply is usually unable to act quickly enough to the sudden increase in demand. When a sudden change in weather happens like this, the natural gas that is stored is used to help soften the impact of the quick increase in demand.

- During winter months when it is cold, natural gas is used for heating so the supply for the gas increases, which increases the price.

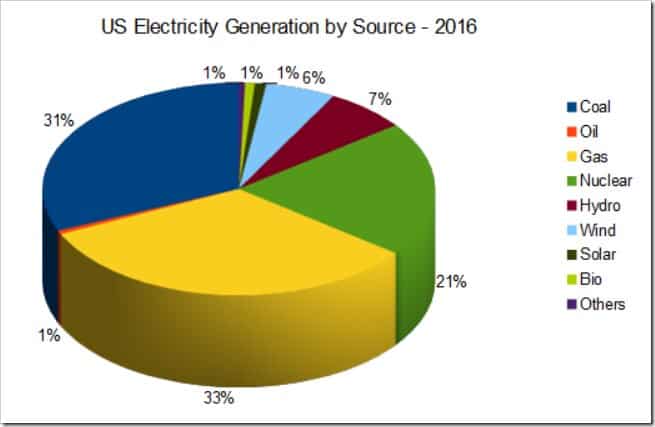

- During summer months when it is hot, demand increases for natural gas. About 30% of electricity is powered by natural gas so when the sun is pounding and we feel that “Texas heat,” the demand for air conditioning increases which in turn leads to the higher demand for natural gas thus increasing the pricing.

- Petroleum prices

- To avoid the confusion on why petroleum would affect natural gas, it is because petroleum fuels may be an economical substitute for natural gas for some consumers.

If there is a higher demand, then prices will rise. Whereas if there is a low demand, then it will likely lead to lower prices.

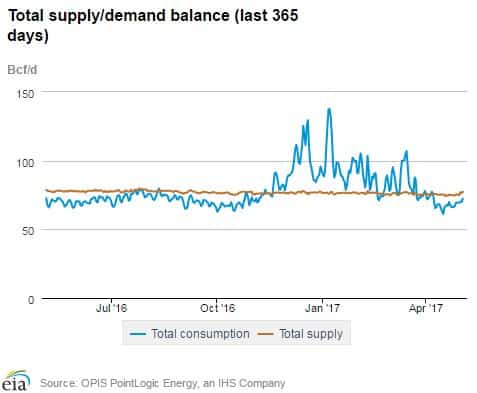

Here you can see a chart showing the flow of supply and demand of natural gas from July to April. You can see how the consumption increases during the colder months.

Do the current low gas prices affect natural gas?

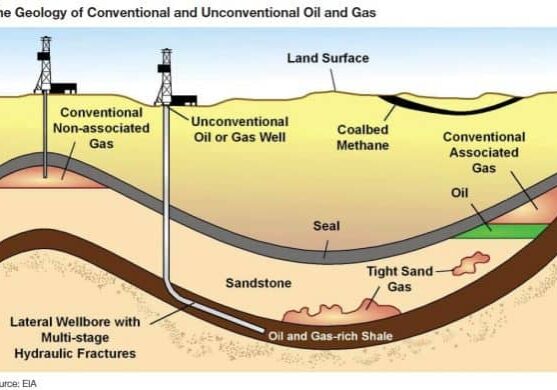

Gasoline prices are of course directly related to oil prices. The price of oil has finally been rising from a dramatic low of $29 per barrel in January 2016 to our current $52 per barrel. In the past, the price of natural gas has always gone along with the pricing of oil because natural gas was produced from the same sort of geological formations as oil. Today, natural gas prices move more independent from oil prices due to a technology that makes it easier to produce higher quantities of natural gas from shale formations. Fracking has been able to cut down natural gas prices in the U.S. throughout the years when the price of oil remained high.

Today, the power sector in the U.S. uses mostly natural gas and coal whereas in the 1970s, they used one in ten barrels of oil. They also have even been shifting from coal to mainly natural gas, “undergoing a cleanup that now will be hard to reverse.” (newrepublic.com) The transition can be linked indirectly to the high cost of oil from the past. So whether natural gas prices rise or fall, it is less likely than ever before that it follows oil prices.

What to expect next

In case you are unaware, like I was, OPEC (Organization of the Petroleum Exporting Countries) signed an agreement that starting January 1, 2017 they would reduce their production to help stabilize the market and rid excess oil supply. Their tactics seem to be helping, oil and gas is on the rise. This is all part of supply and demand which directly affects pricing. The duration of this agreement was originally for a total of 6 months, but now there is talk of extending the agreement. A meeting will be held on May 25th, 2017 that will decide what is to happen next. Will OPEC extend the production cut, or will they decide to increase production to get rid of the U.S. shale producers who have doubled their production in the last year. And where will that leave oil and gas prices?

We will make sure to keep our blogs up to date with the latest news on the OPEC agreement and oil prices.

Click below to see how CROFT contributes to getting natural gas to market by designing and manufacturing processing equipment that is not only reliable and efficient but eco-friendly as well.

http://www.eia.gov/dnav/ng/ng_cons_num_dcu_nus_a.htm

http://www.eia.gov/tools/faqs/faq.cfm?id=43&t=8

http://www.eia.gov/energyexplained/index.cfm?page=natural_gas_factors_affecting_prices

http://www.eia.gov/dnav/ng/ng_pri_sum_dcu_nus_a.htm

http://www.eia.gov/tools/faqs/faq.cfm?id=58&t=8

http://oil-price.net/dashboard.php?lang=en#COMMODITIES

http://www.newrepublic.com/article/119947/oil-prices-wont-hurt-green-gains