Of course working in the oil and gas industry I am hearing a lot about the fallen oil prices. Even so, people that have nothing to do with the industry are also talking about it quite frequently. Let’s face it, this is a hot topic right now. Some of us are loving it but many of us are hurting. A couple of weeks ago, I wrote a blog over what impacts the price of natural gas. After that blog and with all this talk of the price of oil plummeting, naturally, I am very interested to dig deeper to learn about how natural gas is being affected through all of this.

Let’s start with oil…

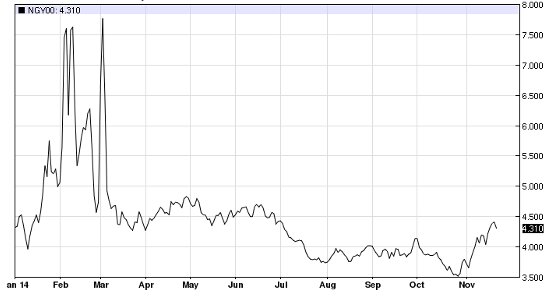

The pricing for oil is based on a global scale since it is easily shipped and a global commodity. The main reason for this price dip is caused by Saudi Arabia and OPEC lowering the price to Asian countries without cutting production, stifling American oil expansion. Oil prices have fallen from above $100 to below $50 a barrel. Below, you can see a price chart of oil and when the drop began. Because of this, the short term outlook for oil isn’t looking good. The value of oil stocks has declined, most of the investments took a hit, and oil producers are seeing smaller profits causing them to scale back drilling. Sure…on the consumer side, this is a good thing but for the industry, this is far from a good thing resulting in things such as layoffs. This, of course, has been the talk of the town but I would like to shift to something that can help keep some of our chins up.

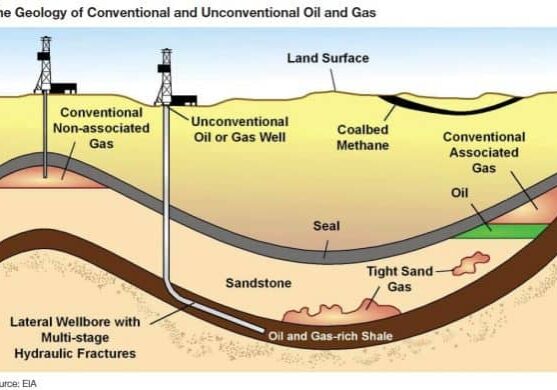

Natural gas comes from the same wells so those prices will be affected too right?

Wrong! The president of the Louisiana Oil and Gas Association, Don Briggs, stated that oil and natural gas are affected by different markets therefore, oil prices should not have any impact on the natural gas industry. See, natural gas is a domestic market. It is much harder to transport overseas than oil so its price is much more localized. Natural gas has its own market so what is affecting oil, won’t necessarily affect gas.

A good thing about natural gas is that it is pretty predictable when the demand will change which in turn will affect the price. Just as we learned in my other blog, the weather is a huge factor in demand for natural gas. So in the winter months, demand is higher than in the warmer months when heating isn’t needed. During the warmer months, such as summer and fall, drillers work diligently to be able to replenish gas storage that way when demand is high during winter, the industry won’t take a hit. If you take a look at the natural gas price chart, you can see the price increase during cold months.

Now, due to a colder than average winter last year as well as in 2013, natural gas that is in storage has been left at record lows. This winter has been predicted to be milder. However, if there are any cold spells, the price will increase which will be in the investors’ favor. So as for the short term future for natural gas, it is relatively opposite of oils short term future. Natural gas prices are rising due to the temperatures cooling off therefore the demand is increasing. And even better, if there is colder weather than predicted, that will raise prices even more.

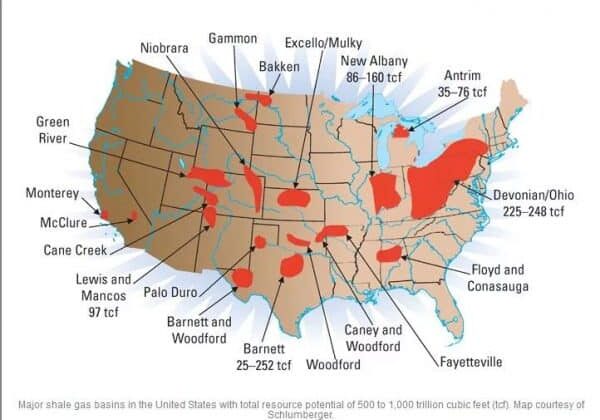

Now as for long-term, natural gas is still coming in strong. Other countries are beginning to turn to natural gas instead of coal for many reasons, one being the issues of smog.

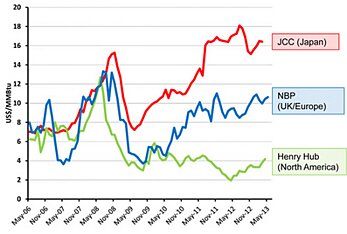

Foreign markets such as the European Union, Russia, Asia, China, India, and Taiwan all have higher natural gas prices as compared to the United States where we have a lot of supply. For example, Japan sees prices during the winter at $16 per MMBtu where it is about $4 per MMBtu in the U.S. Because of this, America sees a new market and by the end of next year, LNG exports are to be up and running which in turn, will be favorable to investors looking for a long term future in natural gas.

Okay, as if I haven’t bragged about natural gas enough, I just have one more thing to say how awesome it is. Natural gas has brought certain parts of manufacturing back to the United States. Some examples of these are fertilizer, plastics, and chemicals which bring even MORE long term value to natural gas.

With oil prices continuing to decrease, it is important that drilling continues to remain efficient. One way to do that is by focusing on natural gas which has shown to be a constant and growing price/demand. CROFT is there to help continue to process natural gas efficiently and effectively to bring to market. Even with oil and gas companies feeling tight right now, CROFT not only sells units but also leases them offering an economical alternative. Check out our product line and services to learn more!

http://www.nola.com/business/baton-rouge/index.ssf/2014/11/falling_oil_prices_shouldnt_af.html

http://www.energyandcapital.com/articles/natural-gas-prices-vs-crude-oil-prices/4671